Income Tax Notice

Income Tax Notice: Check & Authenticate ITR Notices Online

Even after filing your Income Tax Return (ITR) on time, you may still receive notices from the Income Tax Department (ITD). While this can be concerning, it is often a routine part of the tax process. Some notices request additional information or clarifications that require timely responses, while others are simply for your information. It is important to carefully verify the authenticity of any notice before taking further action to ensure proper compliance and avoid unnecessary penalties.

caselaadvisors helps you handle income tax notices quickly and easily. We assist in verifying notices and preparing the right responses. Get expert support to stay compliant and avoid penalties.

What is an Income Tax Notice?

An income tax notice is an official letter sent by the Income Tax Department to a taxpayer. It informs the taxpayer about an issue or query related to their tax return or tax payments. The notice could be about missing information, discrepancies in the filed return, tax assessments, or a request for additional documents. When a taxpayer receives such a notice, they are required to respond within the given time to resolve the matter with the tax authorities.

Types of Income Tax Notices

The Income Tax Department issues various types of notices depending on the reason for communication. Some common types include:

- Notice under Section 142(1): Requests additional information or documents related to your filed return, or asks you to file a return if not filed.

- Notice under Section 139(9): Issued when a return filed is found to be defective or incomplete.

- Notice under Section 148: Issued when the department believes income has escaped assessment or the return was not filed.

- Notice under Section 156: Issued when there is a demand for tax, penalty, or other dues to be paid.

- Intimation under Section 143(1): A computerised intimation after processing your return, showing any tax due or refund.

- Notice under Section 143(2): Indicates your return has been selected for detailed scrutiny.

- Notice under Section 131: Issued when the officer suspects concealment of income.

- Notice under Section 245: Relates to adjustment of refunds against outstanding tax demands.

Each notice serves a specific purpose and requires a timely response to avoid penalties.

IT Notice Under Section 133(6)

Under the E-Verification Scheme 2021, the Income Tax Department may issue a notice under Section 133(6) if discrepancies are found between the data reported in your Income Tax Return (ITR) and the information available in the Annual Information Statement (AIS).

Common Reasons for Receiving Notice u/s 133(6):

- ITR not filed even though income exceeds the basic exemption limit as per AIS data.

- Income such as salary, interest, or capital gains is reflected in the AIS, but not correctly reported in the ITR.

- Significant expenses (e.g., purchase of property, foreign travel, mutual fund/stocks investments) are reported in AIS but are inconsistent with the income declared in the ITR.

Steps to Respond to Notice u/s 133(6):

Review the notice carefully and compare the AIS data with your ITR to identify if the mismatch is due to an error on your part or by the department.

- Log in to the Income Tax Portal: Navigate to: Login > Pending Actions > Compliance Portal > E-Verification

- Submit Your Response: Fill in the questionnaire provided under the e-verification section and upload the necessary supporting documents.

If the Mistake Is Yours

- You may file an Updated Return under Section 139(8A).

- Pay any additional tax liability and applicable penalties voluntarily.

- Submit your response accordingly through the portal.

- If the Error Is on the Department’s Side

- Provide a clear explanation through the Insights Portal.

- Attach supporting documents to prove your case.

Income Tax Notice u/s 133(6) Sample

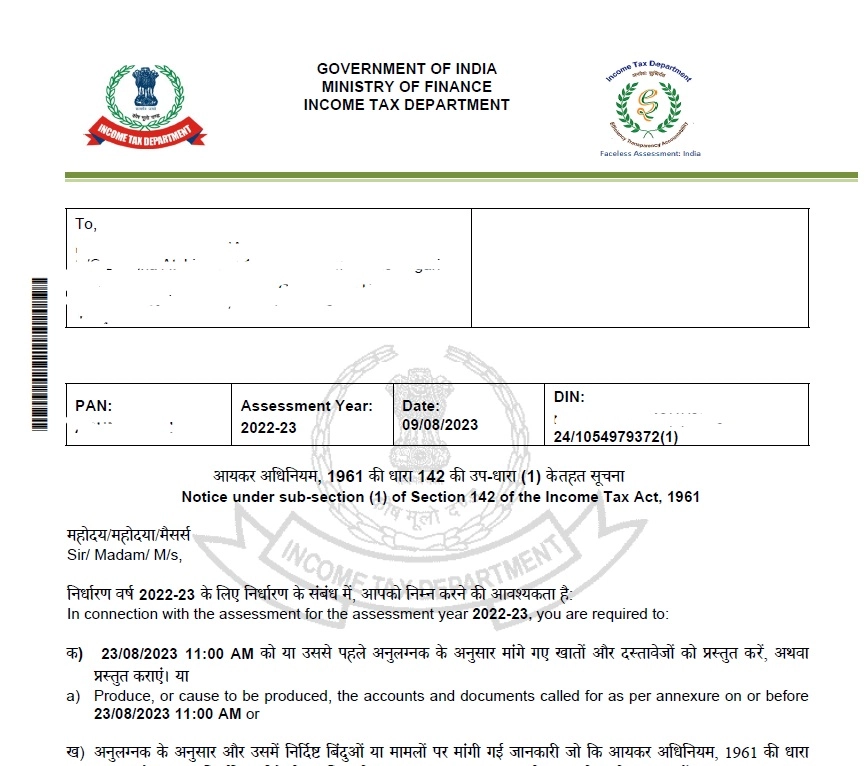

Notice Under Section 142(1)

A notice under Section 142(1) of the Income Tax Act is issued by the Assessing Officer (AO) in the following two situations:

- If you have filed your Income Tax Return, but the AO requires additional information, documents, or clarification to complete the assessment.

- If you have not filed your return, the AO directs you to file it within the prescribed time.

This notice is aimed at gathering the necessary details to ensure a fair and complete assessment of your income.

Consequences of Not Responding to Notice u/s 142(1):

- A penalty of ?10,000 for each instance of non-compliance.

- Prosecution, which may lead to imprisonment for up to 1 year.In some cases, both penalty and prosecution may apply.

Copy of Section 142(1) Notice

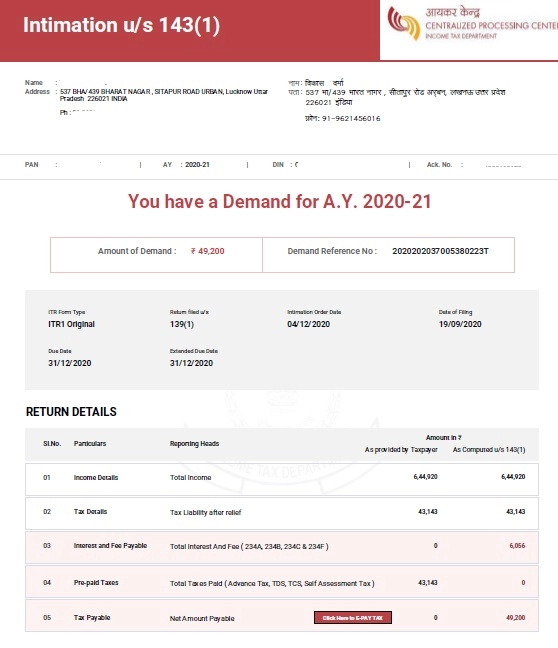

Intimation Under Section 143(1)

Once you file your Income Tax Return (ITR), it is electronically processed by the Central Processing Centre (CPC). During processing, the income is recalculated after making certain automatic adjustments, such as:

- Correction of any arithmetical errors

- Disallowance of incorrect claims is clearly evident from the return

- Rejection of losses or expenses wrongly claimed

- Addition of income not reported in the return

After processing, the CPC issues an Intimation under Section 143(1) in any of the following three cases:

- Tax is payable by the taxpayer

- Refund is due to the taxpayer

- No tax or refund, but there is a change in the amount of loss carried forward

The intimation must be sent within 9 months from the end of the financial year in which the return was filed.

Example: If your return for AY 2024–25 was filed on 27 July 2024, the intimation can be issued up to 31 December 2025.

Note: Processing under Section 143(1) has been mandatory since Assessment Year 2017–18.

How to Analyse an Intimation u/s 143(1)?

Review the comparison between the figures filed in your ITR and the ones recalculated by the CPC.

Identify any mismatches in:

- Income

- Deductions

- TDS or prepaid taxes

If the mismatch or demand is due to an error, you can file a rectification request under Section 154 within 4 years from the end of the relevant assessment year.

If the tax demand is correct, pay the amount using the payment link provided in the intimation.

Notice Under Section 143(2)

A notice under Section 143(2) is issued when your income tax return is selected for scrutiny. This means the Assessing Officer (AO) wants to examine your return in detail to ensure that:

- You have not understated your income

- You have not claimed excessive losses

- You have not paid less tax than required

This notice is usually followed by a questionnaire and a request for supporting documents. The AO must issue this notice within 3 months after the end of the relevant assessment year.

Example: If Mohan filed his return on 19 June 2024 for AY 2024–25, then the last date for issuing notice under Section 143(2) would be 31 August 2025.

How to Respond to Notice u/s 143(2):

- Review the Notice Thoroughly

- Read the notice and its annexure carefully to understand the reason for scrutiny.

- Prepare Your Response

- Draft a cover letter with a clear explanation addressing all queries honestly.

- Attach all supporting documents requested.

- Submit the Response Online

- Log in to the Income Tax e-filing portal.

- Go to e-Proceedings, upload your cover letter and documents, and submit your response.

Sample IT Notice Under Section 143(1)

Notice Under Section 245

A notice under Section 245 is issued when the Assessing Officer (AO) finds that you have an outstanding tax demand from previous years, and they intend to adjust it against your current year’s refund.

However, such an adjustment can only be made after:

- Issuing a proper notice, and

- Giving you an opportunity to respond

Response Timeline: You must respond within 30 days from the date you receive the notice. If you do not respond within this period, the AO may assume that you agree to the adjustment and go ahead with the process.

Important Tip: It’s highly recommended to respond promptly and verify the accuracy of the tax demand before the refund is adjusted.

Notice Under Section 245

A notice under Section 245 is issued when the Assessing Officer (AO) finds that you have an outstanding tax demand from previous years, and they intend to adjust it against your current year’s refund.

However, such an adjustment can only be made after:

- Issuing a proper notice, and

- Giving you an opportunity to respond

Response Timeline: You must respond within 30 days of the date you receive the notice. If you do not respond within this period, the AO may assume that you agree to the adjustment and go ahead with the process.

Important Tip: It’s highly recommended to respond promptly and verify the accuracy of the tax demand before the refund is adjusted.

Most Common Reasons for Receiving an Income Tax Notice

You may receive a notice from the Income Tax Department for several reasons. Some of the most common causes include:

1. Mismatch in Income or Tax Details

- Discrepancy between the income reported in your ITR and Form 26AS or AIS.

- Mismatch in Tax Deducted at Source (TDS) amounts.

- Errors or inconsistencies in the details furnished in your return.

2. Non-Filing or Delayed Filing of ITR

- Failure to file your income tax return on time.

- Completely missing the filing deadline without a valid reason.

3. Use of Incorrect ITR Form

Filing your return using the wrong ITR form based on your income type or source.

4. High-Value Transactions

Large cash deposits, property purchases/sales, or credit card payments that are not reflected or properly reported in your ITR.

5. Investments in Spouse’s Name

Making investments in your spouse’s name but failing to disclose them as required under the clubbing of income provisions.

6. Inaccurate Reporting of Capital Gains

Failing to report or misreporting long-term capital gains, especially from equity shares or mutual funds.

7. Incomplete Documentation

Not submitting required supporting documents when requested or filing incomplete information.

8. Random Scrutiny

Your return is picked up for random scrutiny by the Assessing Officer for further verification.

9. Omission of Income

Not disclosing income from other sources such as interest, freelance work, foreign income, or rental income.

10. Outstanding Tax Liability or Refund Adjustment

If you have a pending tax liability from earlier years and a refund is due, the department may adjust your refund against that liability and issue a notice under Section 245.

11. Non-Payment of Self-Assessment Tax

Submitting your return without paying the self-assessment tax due, which results in an incomplete filing.

12. Suspected Tax Evasion

If the department believes that you have deliberately evaded tax in past financial years.

What to Do After Receiving an Income Tax Notice

If you receive a notice from the Income Tax Department under any of the applicable sections, it’s important to act promptly and correctly. Here are the steps you should follow:

Read the Notice Carefully

Understand the purpose of the notice—whether it’s for a mismatch, non-filing, scrutiny, demand, or any other reason. This will help you determine the right course of action.

Verify the Details

Ensure the notice is actually meant for you by checking the following:

- Your full name

- PAN (Permanent Account Number)

- Address

- Assessment Year

These details must match your records to confirm the notice is genuine.

Identify the Issue or Discrepancy

Try to find out what triggered the notice. This could be:

- A mismatch in reported income or tax credits

- Failure to file a return

- Incorrect form selection

Unreported high-value transactions, etc.

Check Online on the e-Filing Portal

Log in to your Income Tax e-filing account and:

- Confirm that the notice appears in your account under “e-Proceedings” or “View Notices/Orders”.

- Check for any specific instructions or deadlines.

Respond Within the Time Limit

It is critical to respond to the notice within the specified time frame mentioned. Delays may lead to penalties, interest, or even prosecution, depending on the nature of the notice.

Support Your Response with Proper Documentation

When replying:

- Include relevant documents and evidence (e.g., Form 16, bank statements, investment proofs).

- Make sure your explanation is clear and accurate.

Legal Consequences of Ignoring an Income Tax Notice

Ignoring an income tax notice can lead to serious consequences. You may face penalties, interest on unpaid taxes, or your return may be treated as invalid. This can result in loss of exemptions, disallowance of losses, and additional tax liability. In some cases, legal action or prosecution may also follow. Ignoring such notices can damage your financial credibility, so it’s important to respond promptly and correctly.

Essential Documents to Respond to an Income Tax Notice

Here is a list of commonly required documents when replying to an income tax notice:

Copy of the Income Tax Notice: The original notice received from the Income Tax Department.

- Proof of Income

- Salary slips

- Form 16 (Part B)

Income from business or profession statements (if applicable)

- TDS Certificates

- Form 16 (Part A)

- Form 16A for non-salary TDS

Investment Proofs (if deductions or exemptions are claimed)

- LIC premium receipts

- PPF passbook

- ELSS mutual fund statements

- Tuition fee receipts, etc.

- Bank Statements

To verify transactions or income entries

- Form 26AS / AIS (Annual Information Statement)

- To match TDS and income reported by third parties

ITR Acknowledgement / Computation Sheet

- For the relevant assessment year

- Any Other Supporting Documents

Documents specific to the issue raised in the notice (e.g., capital gains reports, rent agreements, loan statements)

How to Verify a Notice or Order Issued by the Income Tax Department (ITD)

Before responding to any communication received in the name of the Income Tax Department, it’s essential to ensure the notice or order is genuine and officially issued by the ITD.

You can verify the authenticity of any notice, order, or letter through the income tax e-filing portal. Here’s how:

Step 1: Go to the Income Tax e-Filing Portal. On the homepage, find ‘Quick Links’ and click on ‘Authenticate Notice/Order Issued by ITD’.

Step 2: You can verify the document using one of the following two methods:

- Method 1: PAN, document type, assessment year, issue date, and mobile number (Applicable for notices from AY 2011–12 onward

- Method 2: Document Identification Number (DIN) and mobile number (Valid for all assessment years)

Step 3 (Method 1): If you choose to authenticate using PAN and other details: Select this option. Enter your PAN, select the document type, input the assessment year, date of issue, and your mobile number.

Step 4: Once you enter the details, an OTP will be sent to your mobile number. Enter the OTP to proceed. If the notice is valid, the system will show the Document Identification Number (DIN) along with the date it was issued. If the document is not found in the system, it will display the message: “No record found for the given criteria.”

Step 5 (Method 2): Alternatively, you can verify using only the DIN and mobile number.

- Enter the DIN and your mobile number.

- Proceed and enter the OTP sent to your mobile.

Step 6: After OTP validation:

- If the document is authentic, the portal will display a success message confirming its validity.

- If it is not a genuine document, it will show: “No record found for the given Document Number.”

How Can Casela advisors Assist with Your Income Tax Notice?

In casela advisors can assist in responding to Income Tax notices through:

- Expert Consultation: Providing personalised guidance from experienced Tax Experts.

- Notice Analysis: Help understand the specifics and requirements of your Income Tax notice.

- Document Identification: Assist in identifying and compiling the necessary documentation for your response.

- Response Preparation: Crafting precise and timely responses to address the Income Tax Department’s concerns.

- Compliance Assurance: Ensuring your response complies with tax laws to minimise further queries or penalties.

Documents Required to Respond to an Income Tax Notice

Depending on the type of notice, you may need:

- Copy of the Income Tax Notice (pdf or hard copy)

- Proof of Income Sources

- For salaried: Part B of Form 16, salary slips, Form 26AS TDS details.

- For professionals: invoices, receipts, bank statement showing receipts.

- TDS Certificates (Form 16A / Form 16) and Challan Copies (Challan 281).

- Investment Proofs (e.g., insurance, mutual funds, fixed deposits).

- Property Documents (sale deed, purchase agreement, valuation reports).

- Bank Statements and Loan Statements (for high-value transactions).

- Accountant / Auditor Certificates (if financial statements have been audited).

- Casela Advisors’ specialists will review the notice, identify required documentation, and guide you on gathering and organizing all proofs for a robust response.

Faqs

FREQUENTLY ASKED QUESTIONS

Check your e-filing account under “View Notices/Order.” Genuine notices appear there and are addressed to your PAN. Verify the notice date, reference number, and your details (PAN, assessment year) to confirm authenticity.

Response timelines vary by section:

-

Notice u/s 143(1): 15 days to revise your return.

-

Notice u/s 139(1): 15 days to rectify a defective return.

-

Notice u/s 245: 30 days to respond to refund adjustment.

-

Other notices: The deadline is specified in the notice—respond before the deadline to avoid penalties or reassessment.

Yes. Under Section 139(5), you can file a revised return before the end of the relevant assessment year or before completion of assessment, whichever is earlier. For notice u/s 143(1), revise within 15 days of notice receipt.

Ignoring a notice can lead to automatic assessment (best judgment), interest & penalties, or recovery proceedings. Always acknowledge and respond within the stipulated timeframe.